【Transcription】Earnings Results for the Second Quarter of Fiscal Year Ending June 2025

-

Capital and Business Alliance With Dai-ichi Life Holdings, Inc.

I would like to present our financial results for the second quarter of the fiscal year ending June 30, 2025.

First, I would like to highlight that we entered into a capital and business alliance with Dai-ichi Life Holdings Inc. on December 18, 2024. On the business side, in particular, as shown on this slide, we plan to collaborate on initiatives aimed at enhancing living environments and developing and expanding real estate-backed financial services.

-

Highlights of the Second Quarter FY6/2025

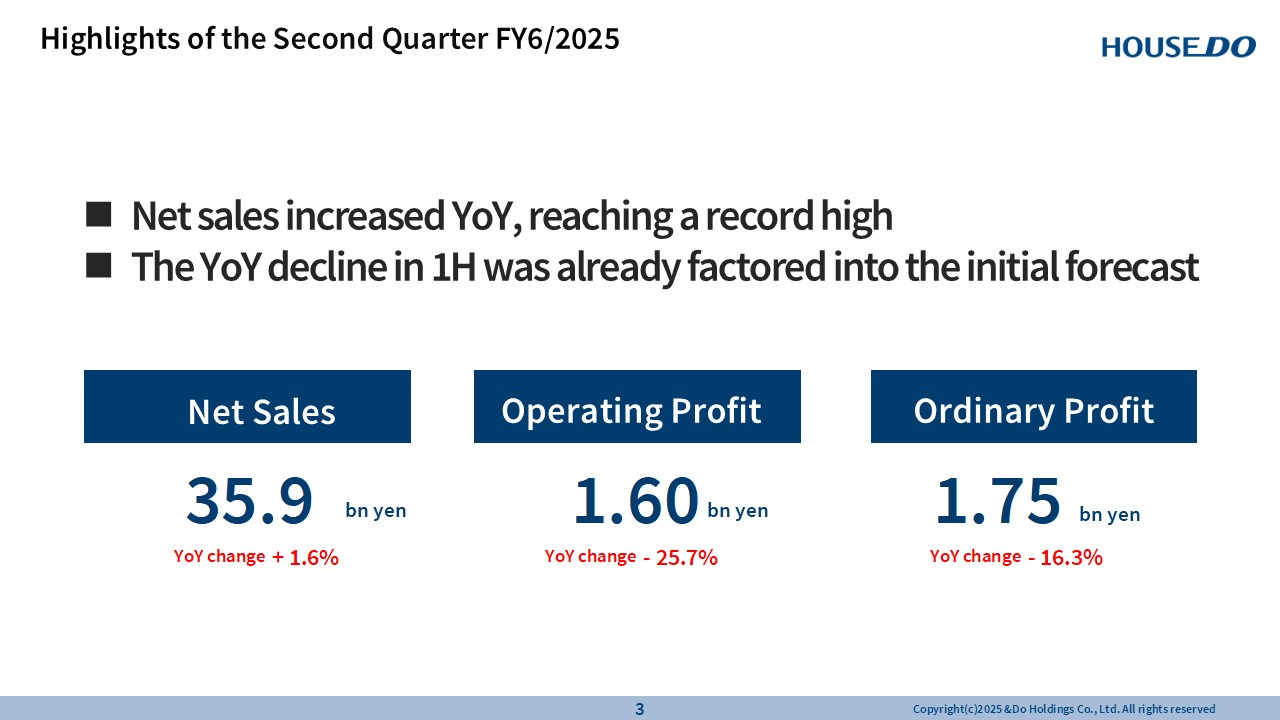

Now, I would like to provide a summary of our financial results for the second quarter.

Thanks to your support, sales exceeded the same period last year and reached a new record high.

However, although sales reached a new record high, sales increased but profits decreased.

The reason for this will be explained later in the PL section, but the decrease in profit for the first half of the same period last year has already been factored into the initial earnings forecast. Regarding ordinary income, we had set a target of 1.8 billion yen, but at 1.75 billion yen, we were slightly short of the target. -

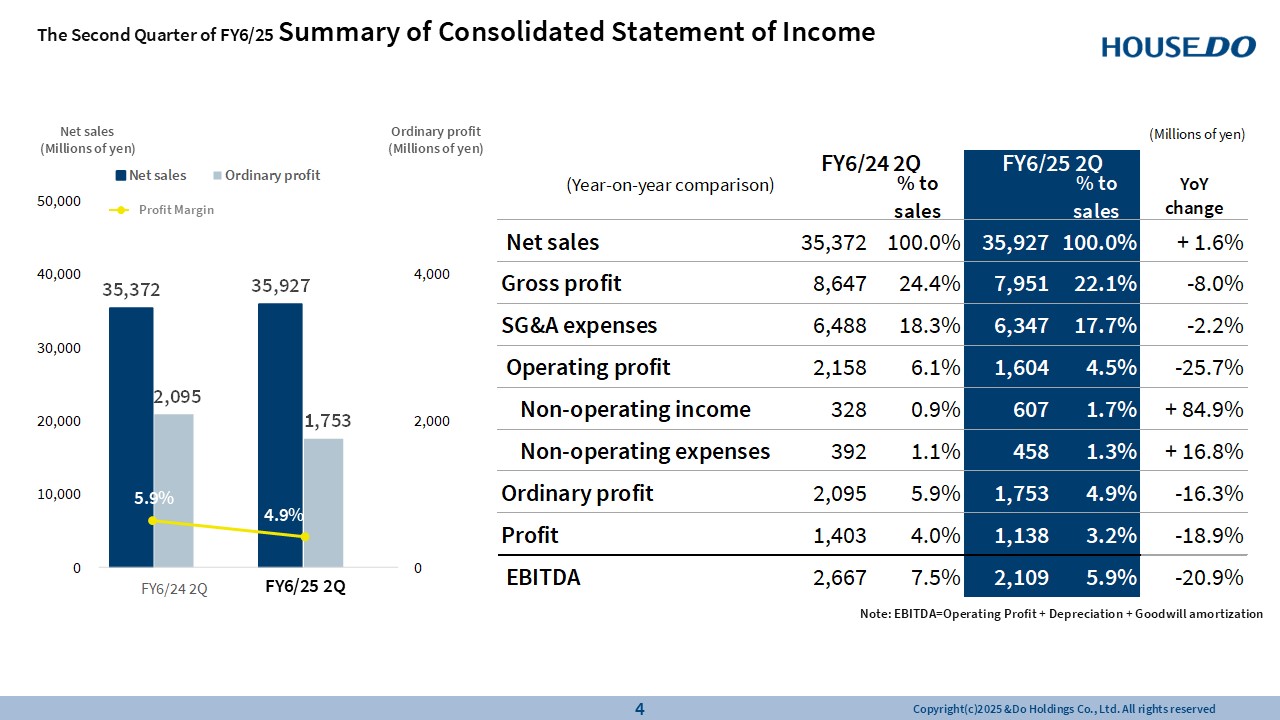

The Second Quarter of FY6/25Summary of Consolidated Statement of Income

Gross profit decreased 8% compared to the same period last year due to lower profit margins on the sale of profitable properties.Meanwhile, general and administrative expenses fell 2.2% year-on-year as we have identified, analyzed, and streamlined various cost items.

-

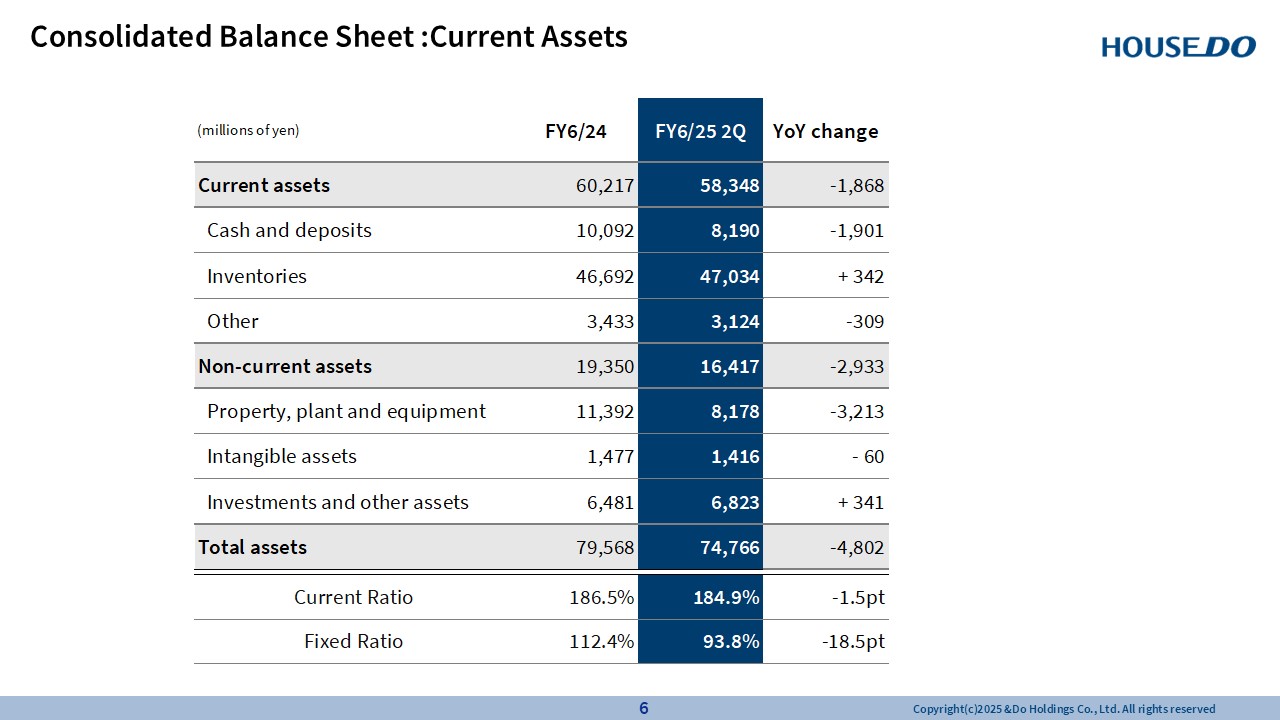

Consolidated Balance Sheet :Current Assets

Let’s take a look at the consolidated balance sheet. First, I would like to focus on the assets section.

Total assets declined from 79,500 million yen to 74,700 million yen, due to the sale of property, plant and equipment. -

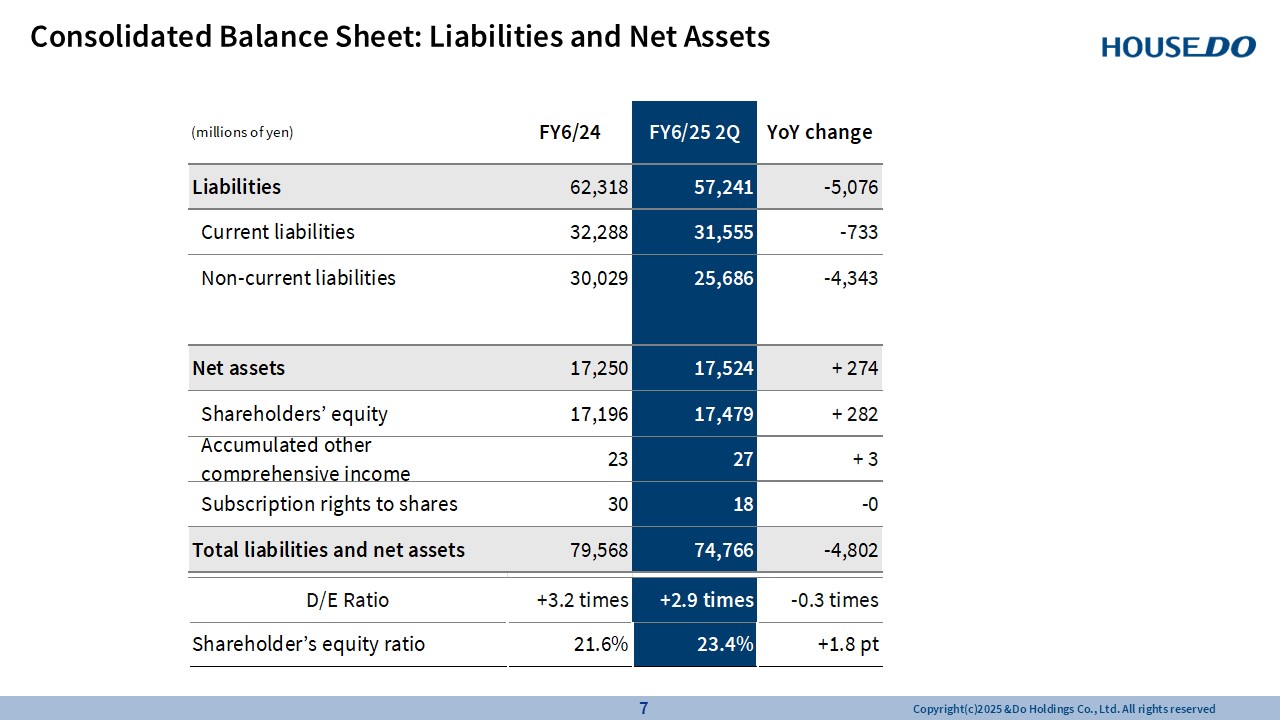

Consolidated Balance Sheet: Liabilities and Net Assets

As shown in the liabilities and net assets section of the consolidated balance sheet, long-term borrowings under non-current liabilities decreased.

Shareholders’ equity ratio was 23.4%, up 1.8 points year-on-year, and we aim to further increase this to 30%. The D/E ratio was -0.3x, reflecting a year-on-year improvement. -

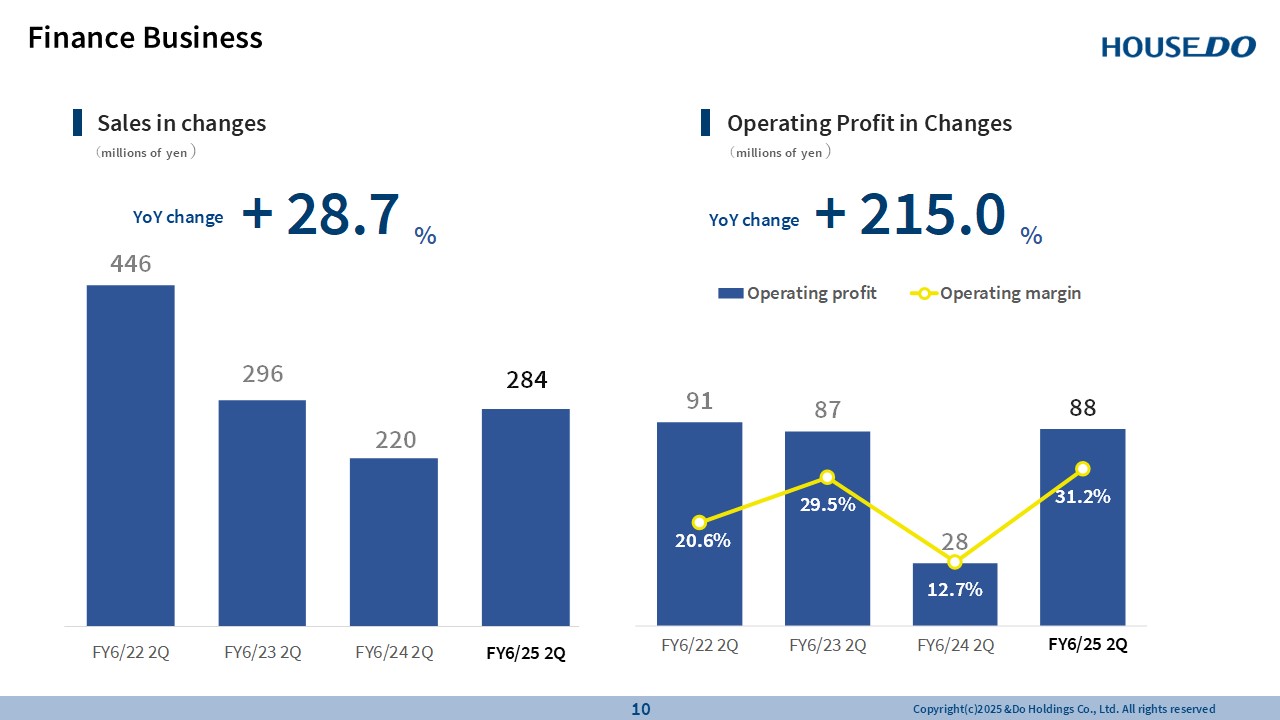

Finance Business

Now, I would like to explain the result of the Finance Business.Net sales for this business increased 28.7% year-on-year.

Operating profit jumped 215% year-on-year to 88 million yen in the second quarter, as the indicator hit bottom in the previous fiscal year and is now in a transitional phase. The net sales and operating profit growth was driven by the expansion of transactions in the guarantee business.

-

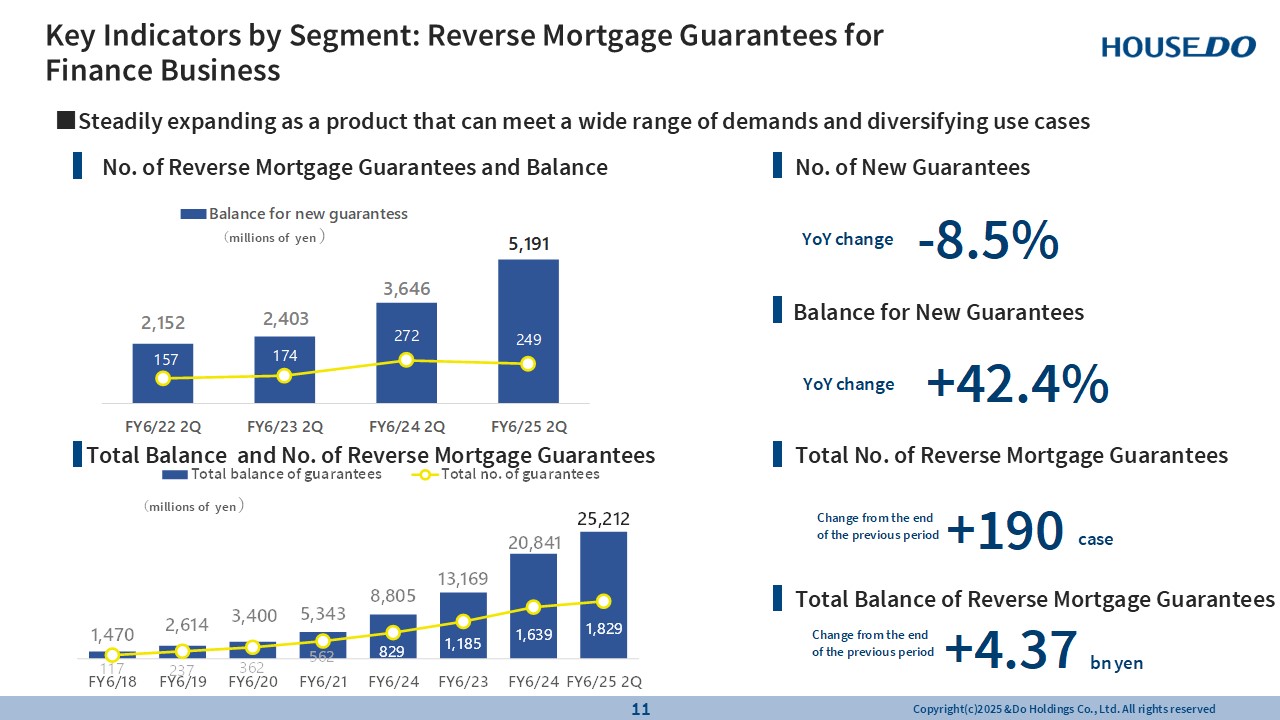

Key Indicators by Segment: Reverse Mortgage Guarantees for Finance Business

Let’s now look at key performance indicators for each segment.

New guarantees grew significantly, expanding from 272 guarantees with a total balance of 3,646 million yen in the same period of the previous fiscal year to 249 guarantees covering 5,191 million yen.

Similarly, the average guarantee value increased from 13 million yen in the same period of the previous fiscal year to 20 million yen, backed by a sharp rise in guarantees covering metropolitan areas.

The increase in the average guarantee value was driven by strong demand for funds, not only for living expenses and housing loan refinancing but also for business financing and inheritance-related needs.

As previously mentioned, the total value of new guarantees increased 42.4% year-on-year, with the total number of guarantees rising 190 and the balance of guarantees up 4,370 million, all increasing significantly year-on-year.

-

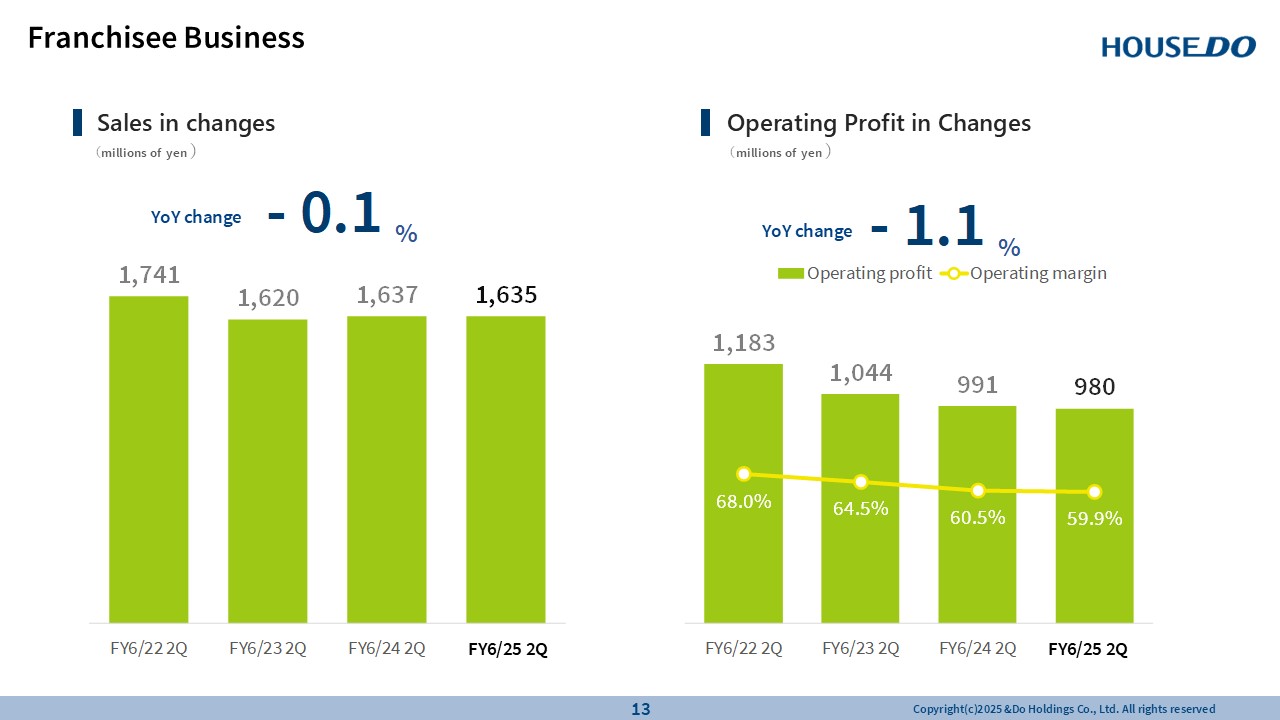

Franchisee Business

I would like to explain the results of each segment.

Let’s begin with the Franchisee Business.

-

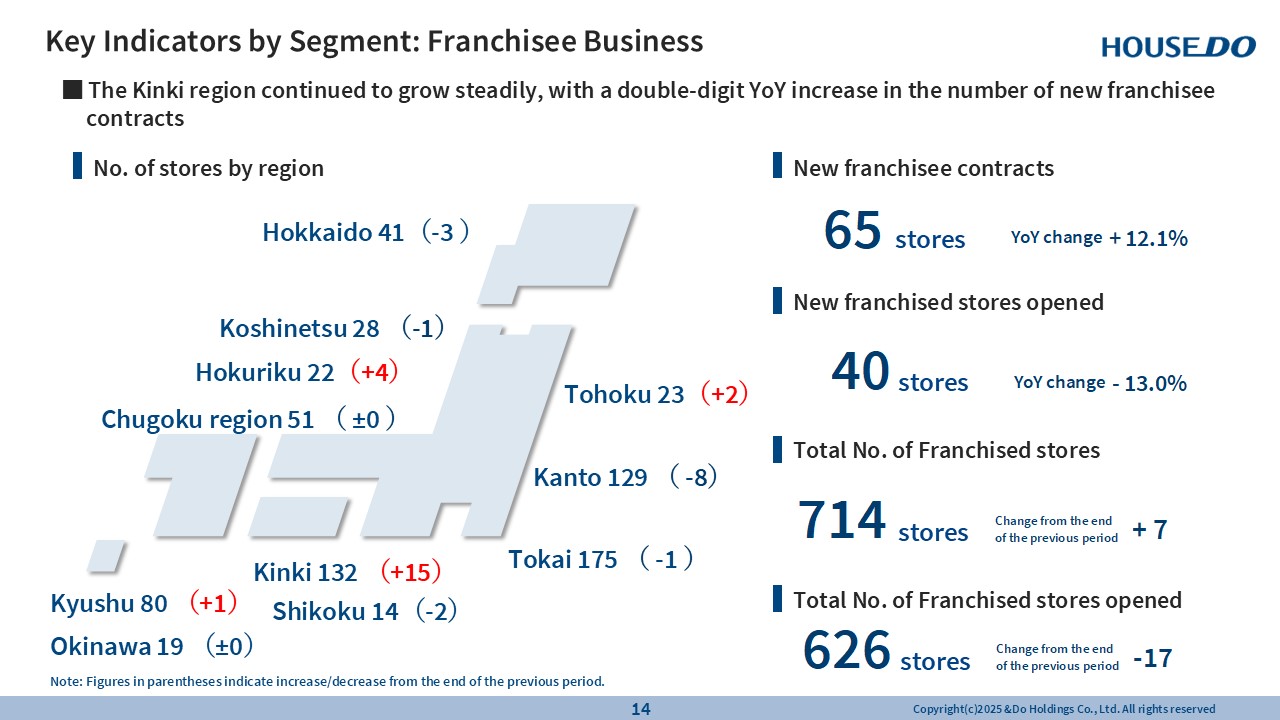

Key Indicators by Segment: Franchisee Business

This is key indicators for franchising. As shown on the slide, I would like to highlight the increase in franchisees in the Kinki region, particularly in Osaka, with the total number of franchised stores reaching 714. -

House-Leaseback Business: Gain on investment in silent partnerships

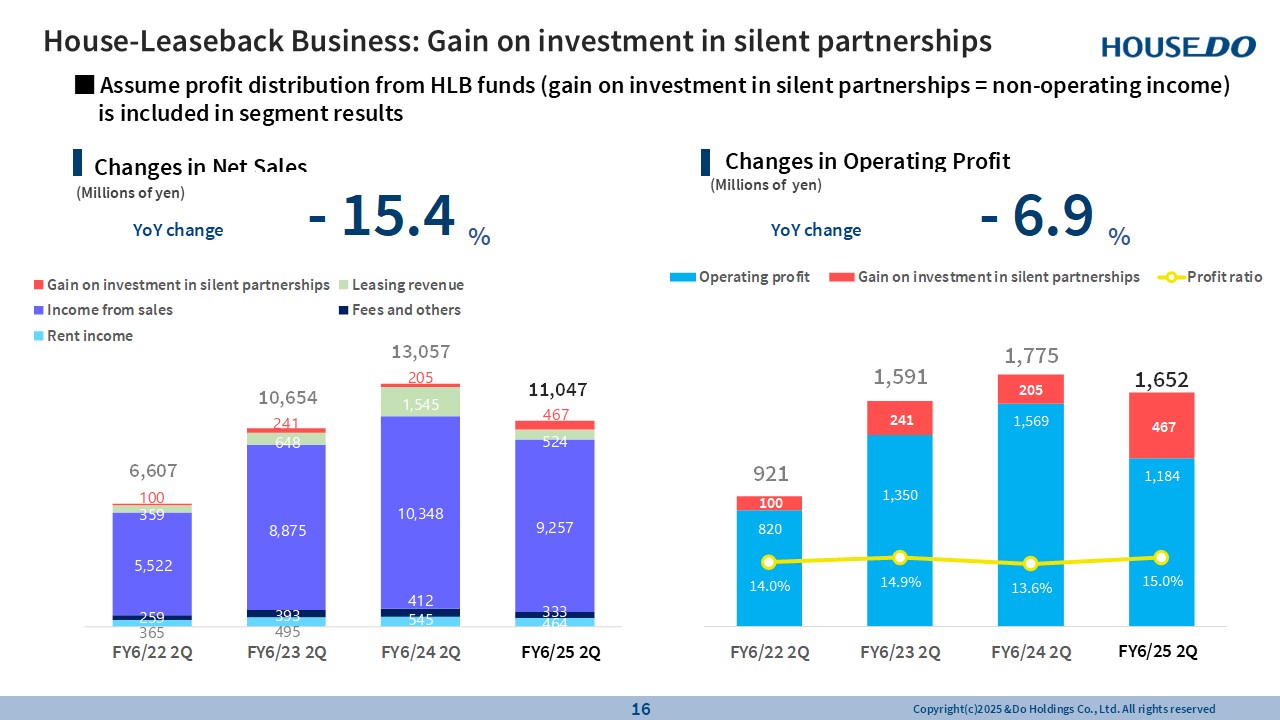

Next, let’s take a look at the House-Leaseback Business.

The segment’s results include gains on investment in silent partnerships. Net sales declined 15.4% year-on-year, and operating profit fell 6.9%.

-

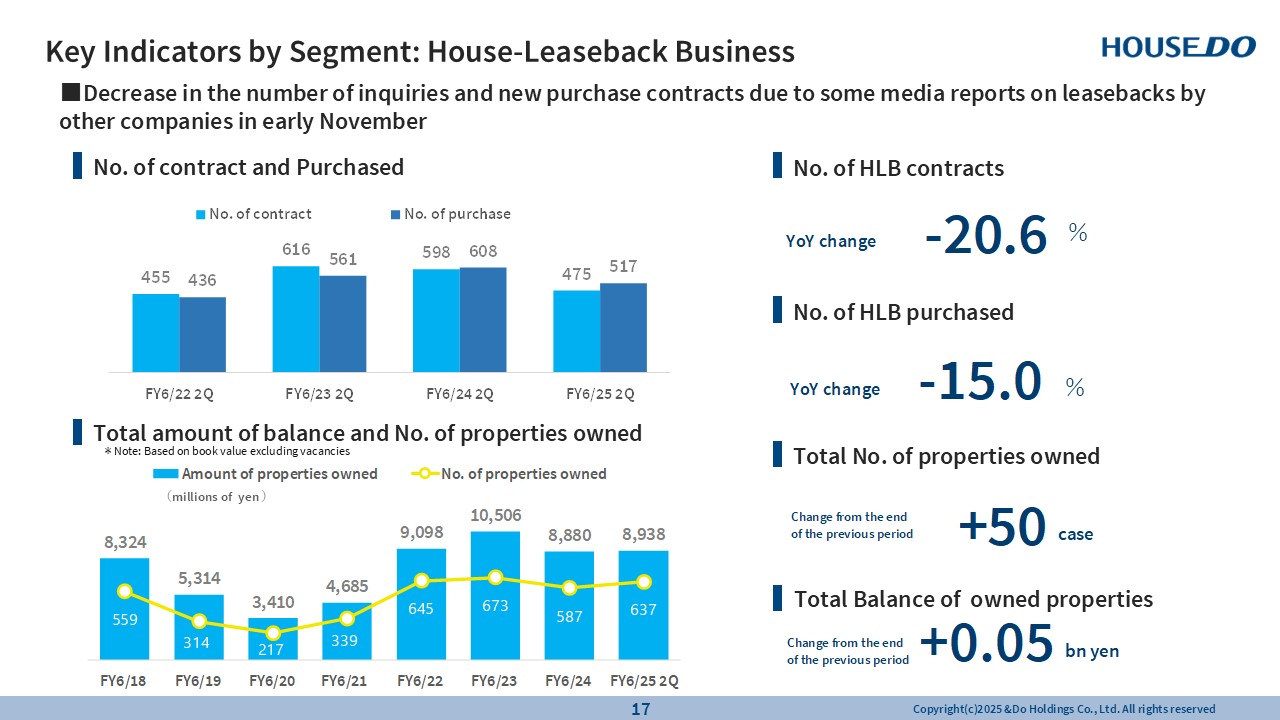

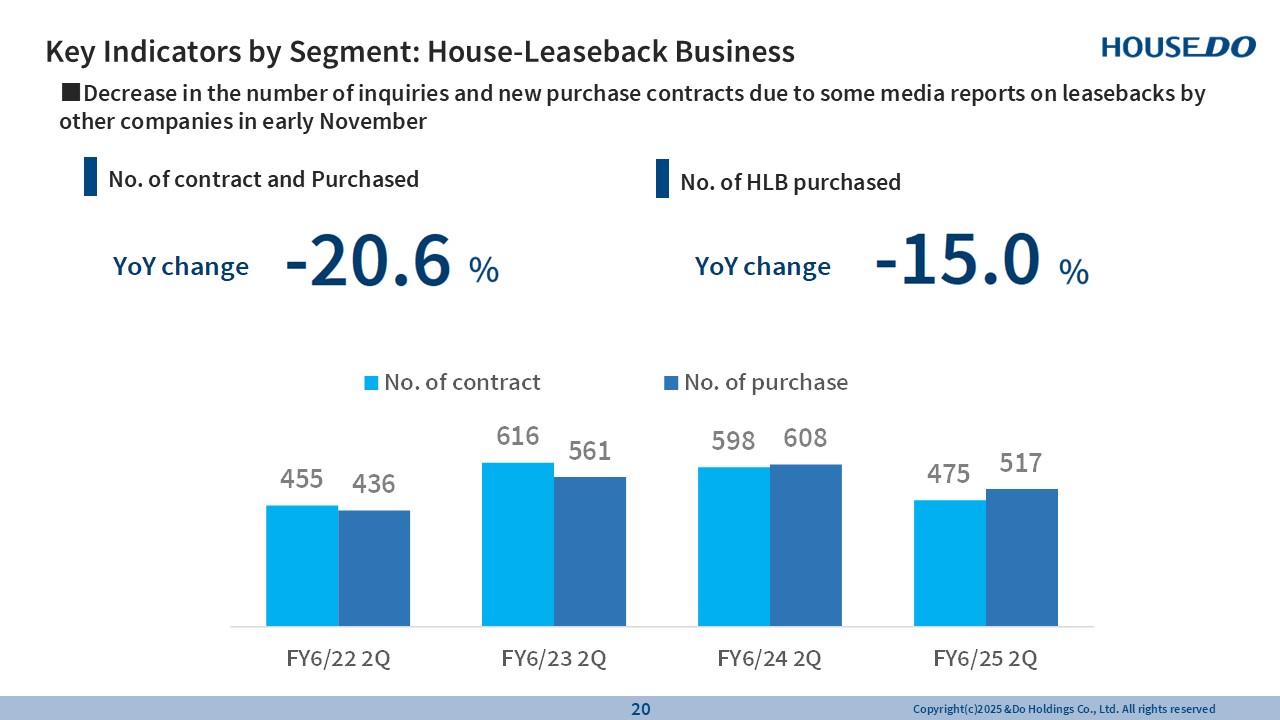

Key Indicators by Segment: House-Leaseback Business

Negative media coverage of another company’s leaseback service in early November 2024 had the most significant impact on demand and new purchase for House-Leaseback contract growth. As a result, property purchase contracts fell 20.6% year-on-year, and the number of newly acquired properties declined 15%. -

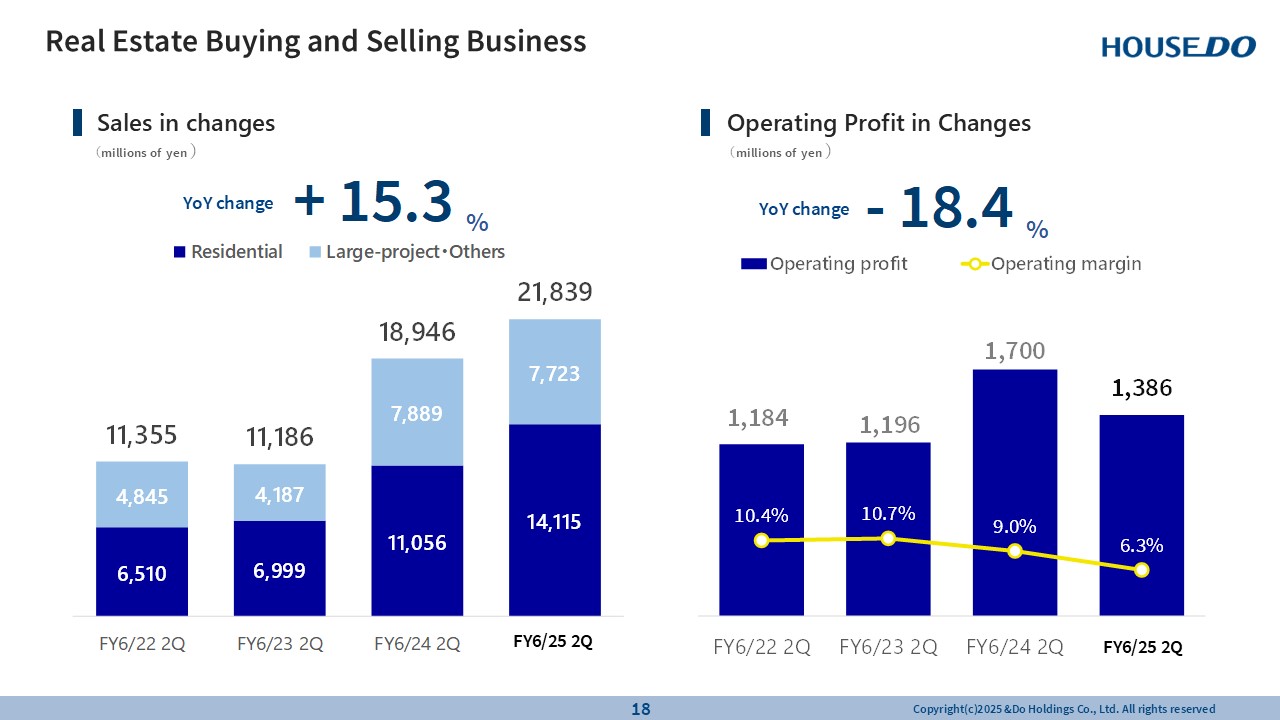

Real Estate Buying and Selling Business

Next, let’s move on to the Real Estate Buying and Selling Business.

Net sales increased 15.3% year-on-year, and operating profit decrease to 18.4%. As shown on this slide, sales of residential properties continue to grow steadily, along with the procurement of pre-owned homes.

We are also working to shorten the inventory turnover period.

Pre-owned homes accounted for 25% of total transactions.

-

Key Indicators by Segment: House-Leaseback Business

I would like to highlight some key points.

In the House-Leaseback Business, purchase contracts declined 20.6% year-on-year, and the number of newly acquired properties fell 15%. These declines were largely due to negative media coverage in early November 2024.

Demand has been slow to recover. We are still analyzing the factors affecting the business; however, since competition has not intensified, we believe the declines are largely attributable to the media coverage. Another possible factor is the growing popularity of reverse mortgages, which have expanded customers’ financing options. While demand is recovering, the pace remains slow, and we are analyzing the reasons for this.

-

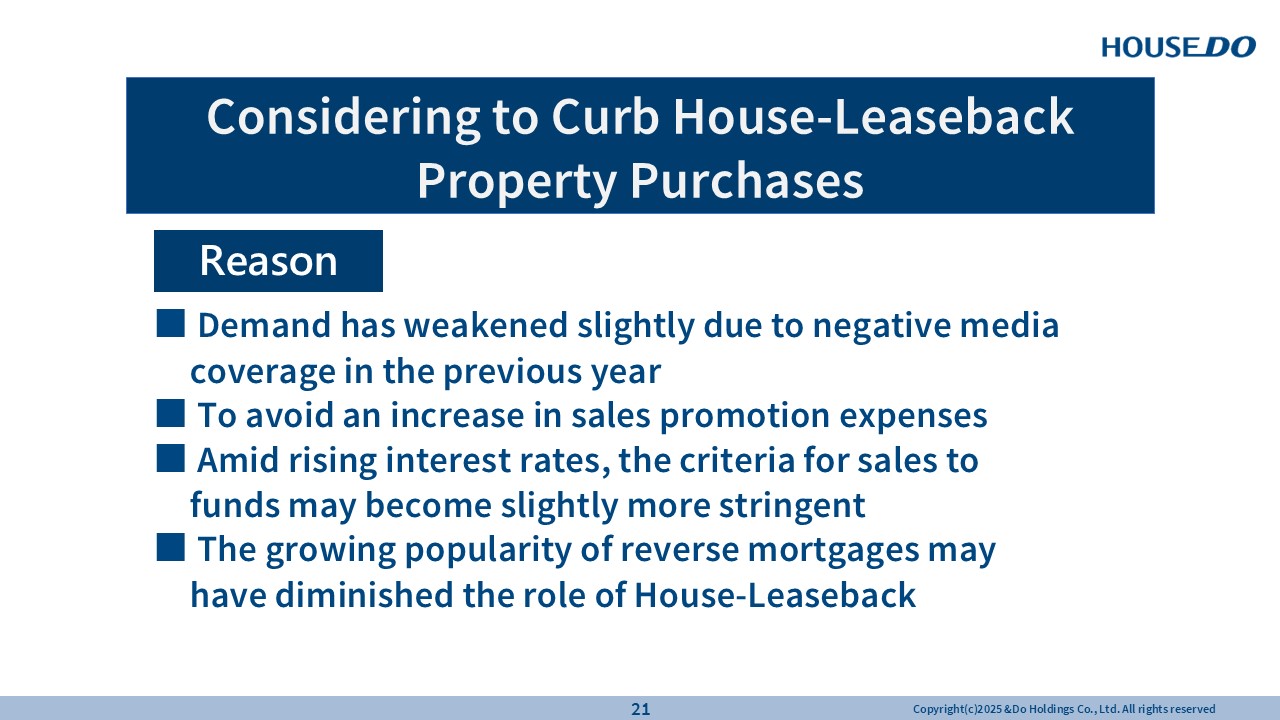

In light of these factors, we are considering slightly curbing the procurement of House-Leaseback properties.

While we have identified several reasons for this beyond the negative media coverage, the most significant factor remains the media impact. We find it unfortunate that House-Leaseback was the subject of negative reporting.

That said, we believe in the value of providing House-Leaseback services, precisely because of this media coverage, to counter the negative perception. However, the media coverage remains a key reason we are considering reducing procurements.

Due to the impact of the media coverage, maintaining the same level of property acquisitions as in the previous fiscal year would require higher net sales promotion expenses. However, increasing these costs would put downward pressure on profit, so we are considering curbing procurements to avoid cost increases.

The third factor presents a medium-term concern as interest rate hikes are being closely monitored across various sectors. Over the next three to five years, the criteria for selling properties to funds may become more stringent, which I believe is the most important factor. Since we sell House-Leaseback properties to funds, tightening of these criteria would have a significant impact on our performance. Given that net sales of House-Leaseback properties typically take six months to a year to complete, we must anticipate market conditions well in advance.

The fourth factor, though still a hypothesis, is the increasing availability of financing options for customers. Reverse mortgages are gradually gaining traction, providing an alternative real estate-backed financing option to House-Leaseback that was previously unavailable. This may be hindering the recovery of House-Leaseback demand.

As such, in addition to last year’s negative media coverage, the growing number of financing options, particularly reverse mortgages, could also be contributing to the sluggish recovery in House-Leaseback demand. I have previously noted that if reverse mortgages become more widespread, the role of House-Leaseback may diminish. However, since reverse mortgages are still in the early stages of growth, it remains unclear to what extent this is affecting demand. That said, given these factors, we may need to adjust our strategy and are currently considering whether to curb property procurement to some extent.

-

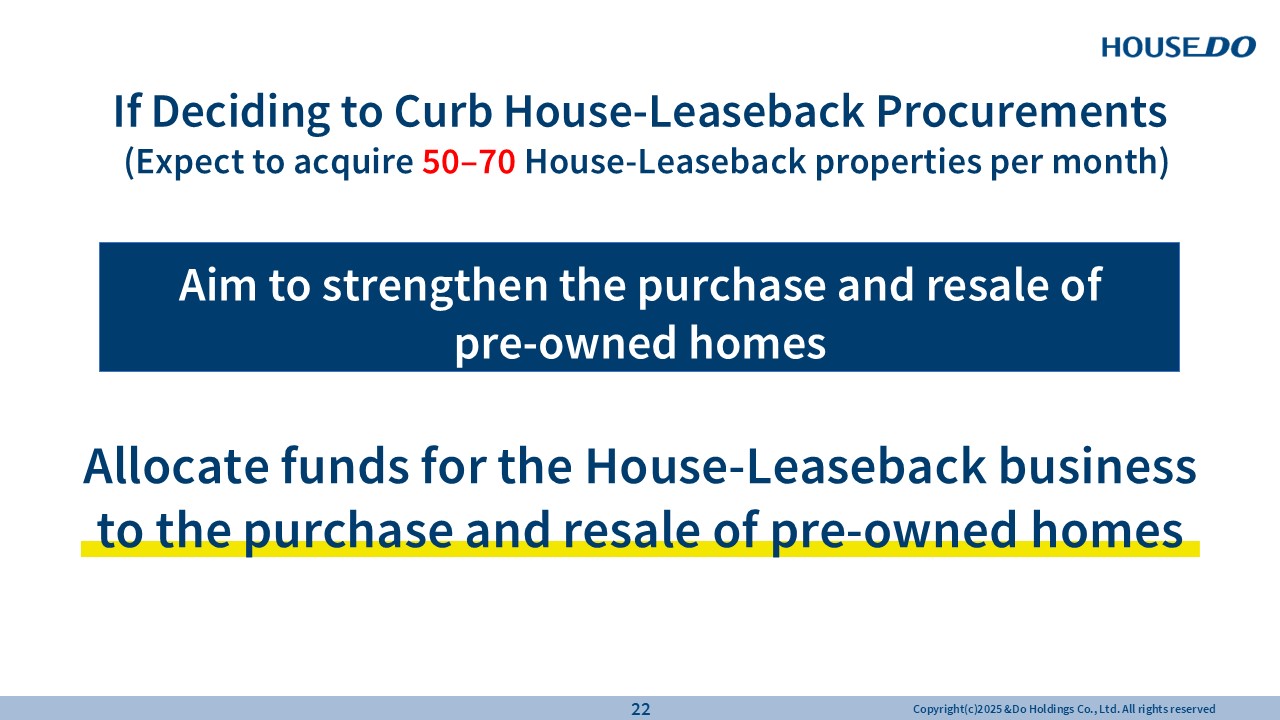

If we decide to curb property procurement, we are considering reducing monthly acquisitions from around 100 properties last year to approximately 50 to 70. While this has not been decided, it reflects our general direction.

In that case, we plan to redirect funds from House-Leaseback to the pre-owned home purchase and resale business instead.

The purchase and resale of pre-owned homes has a higher turnover rate, making it easier to generate profits.

We believe House-Leaseback has played a significant role, as it has helped us identify and understand demand for reverse mortgages, ultimately enabling us to enter the reverse mortgage guarantee business. -

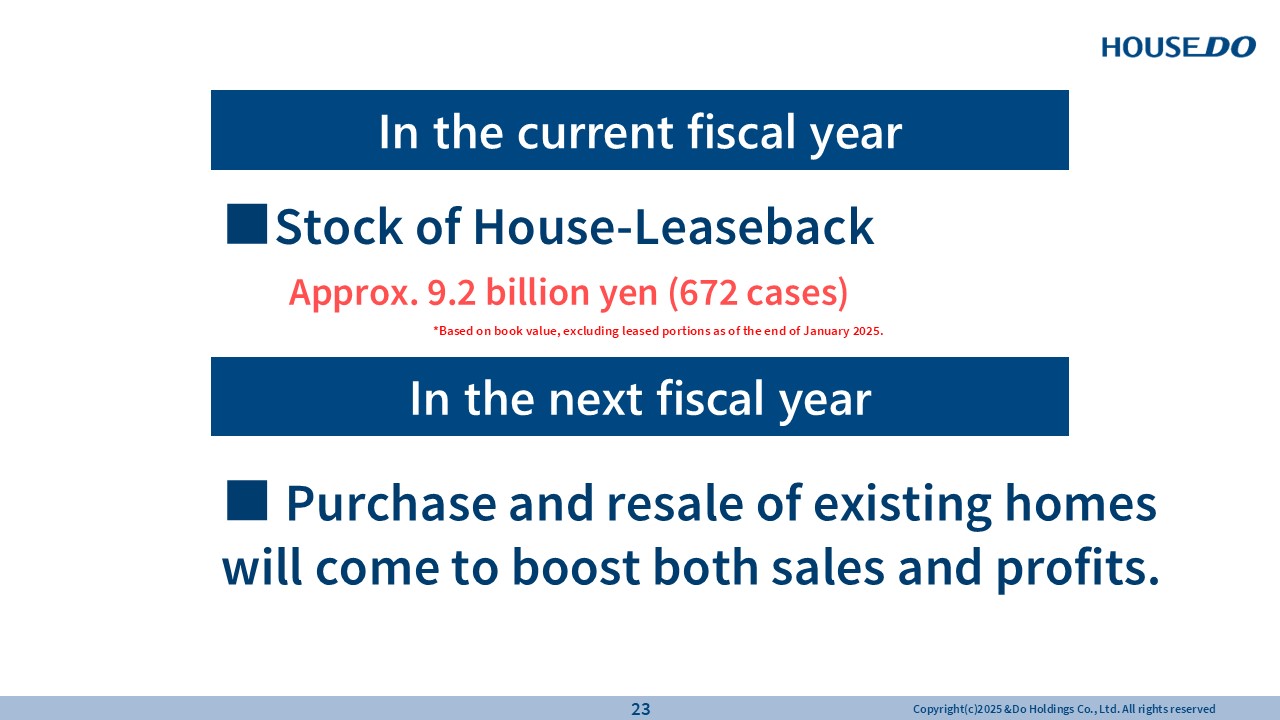

Even if we decide to curb House-Leaseback procurement, we still hold approximately 9,200 million yen in House-Leaseback properties as of the current fiscal year. We plan to sell these properties to funds while continuing to procure House-Leaseback properties diligently.

Since we will be selling our existing properties to funds, any decision to curb House-Leaseback procurement will have minimal impact on the performance of the House-Leaseback Business in the current fiscal year.

If there is an impact, it will be felt in the next fiscal year. We expect net sales value and transaction volume (the number of properties purchased and sold) to decline next year. However, we believe the pre-owned home purchase and resale business to support overall performance. This business is performing well, and we have been actively developing human resources and hiring new employees to strengthen it. Given rising interest rates and inflation, we are confident that the pre-owned housing market will be a key area of focus going forward. We are fully committed to this business and expect it to contribute significantly to both net sales and profit in the next fiscal year.

-

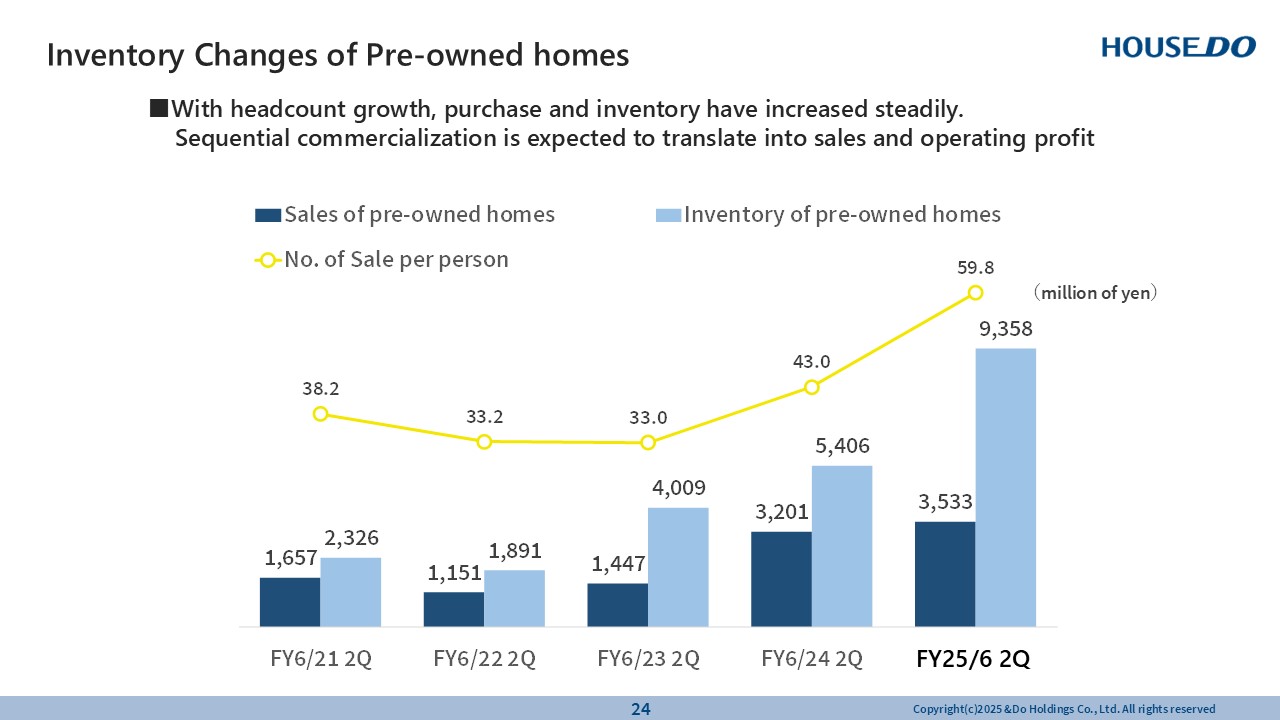

This graph focuses on the pre-owned housing segment within the Real Estate Buying and Selling Business.

We intend to increase pre-owned home purchases, sales from which are recognized after about a seven-month lag. As shown in the bar graph, higher inventory levels drive sales and profit growth in the third or fourth quarter thereafter.

Although interest rates are rising, mortgage rates remain relatively low. We carefully vet and acquire pre-owned properties in prime locations, avoiding less desirable suburban areas. Our focus is on acquiring properties in highly liquid markets and concentrating investments in this area.

Acquiring properties in prime locations will remain a key priority moving forward.

Given these factors, we are considering scaling back the House-Leaseback Business, which requires substantial funds for property procurement and related expenses.

We will disclose our decision as soon as it is finalized, which we expect to be no later than March.

-

Future Role of House-Leaseback

We have identified four key future roles for House-Leaseback.

Since there is a need for this service, I do not believe it will disappear entirely. It remains a highly effective business model and a valuable service. It will continue to serve individuals unable to obtain financing or reverse mortgages. In such cases, House-Leaseback remains a necessary option.

Another role for House-Leaseback is its use in debt processing. We work with banks to help clients sell their properties and repay debts while allowing them to continue living in their homes for a transitional period of one to two years. This is often due to family-related circumstances, such as issues concerning parents or children.

House-leaseback can also serve as a bridge for property transitions. For example, homeowners who have already decided on a new residence may need time to finalize arrangements before moving. Some of these cases involve waiting for a child’s graduation before relocating or elderly parents wishing to remain in their home for another year or two before moving.

The fourth role of House-Leaseback is off-balance-sheet financing for sole proprietors.

As such, there is clear demand for House-Leaseback, and we intend to firmly capture these needs.

While still under consideration, we plan to strengthen our focus on the pre-owned home purchase and resale business and the reverse mortgage guarantee business. As part of our strategy to concentrate resources on core areas, we have recently sold part of our rental management business.

That concludes my key updates.

Thank you very much.