【Transcription】Earnings Results for the Second Quarter of Fiscal Year Ending June 2023

-

Highlights of the Second Quarter FY6/2023

Good morning, everyone. We will announce the financial results for the second quarter. Thank you very much for listening.

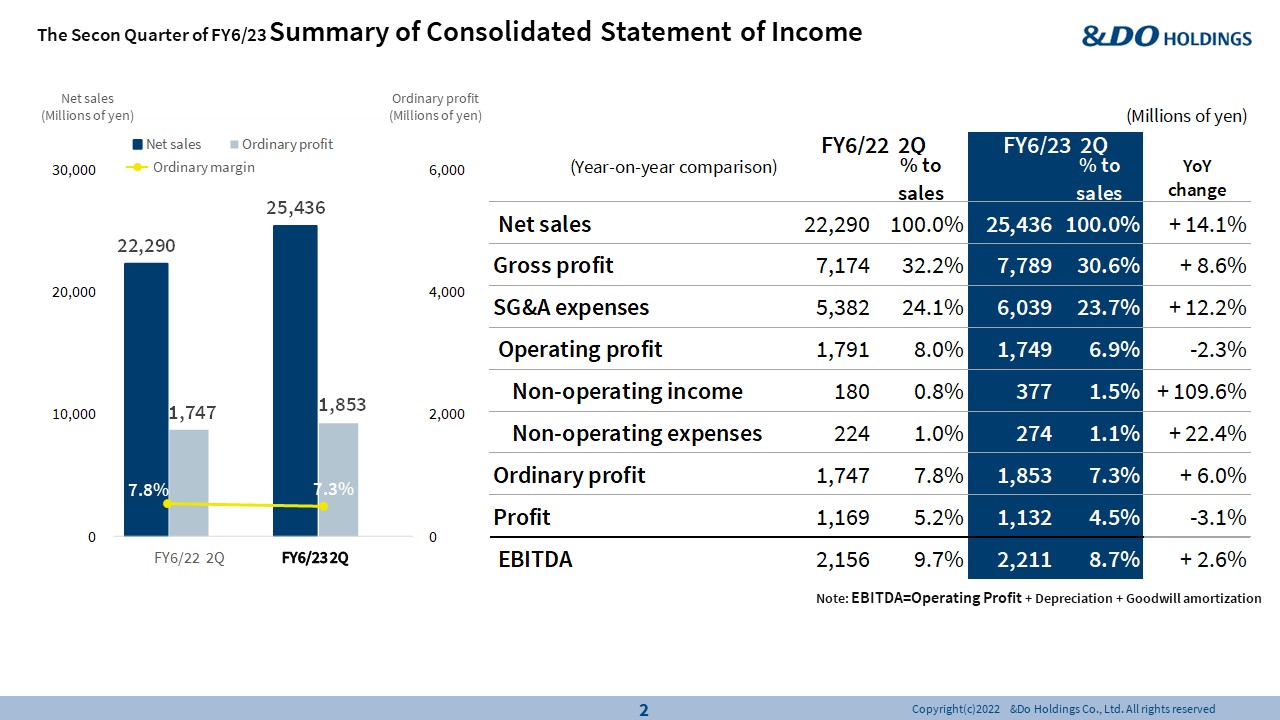

First of all, both sales income and ordinary income have reached record highs. Sales increased by 14.1% compared to the previous year, and ordinary income increased by 6%. -

The Second Quarter of FY6/23 Summary of Consolidated Statement of Income

What I would especially like you to see is this non-operating income. This was sold to a House-Leaseback fund. This will be a regular dividend, and this will continue with the sale to the fund. Since I like the content of the House-Leaseback, the fact that there is regular dividend income means that there is continuity. -

The Second Quarter of FY6/23 Summary of Consolidated Statement of Income

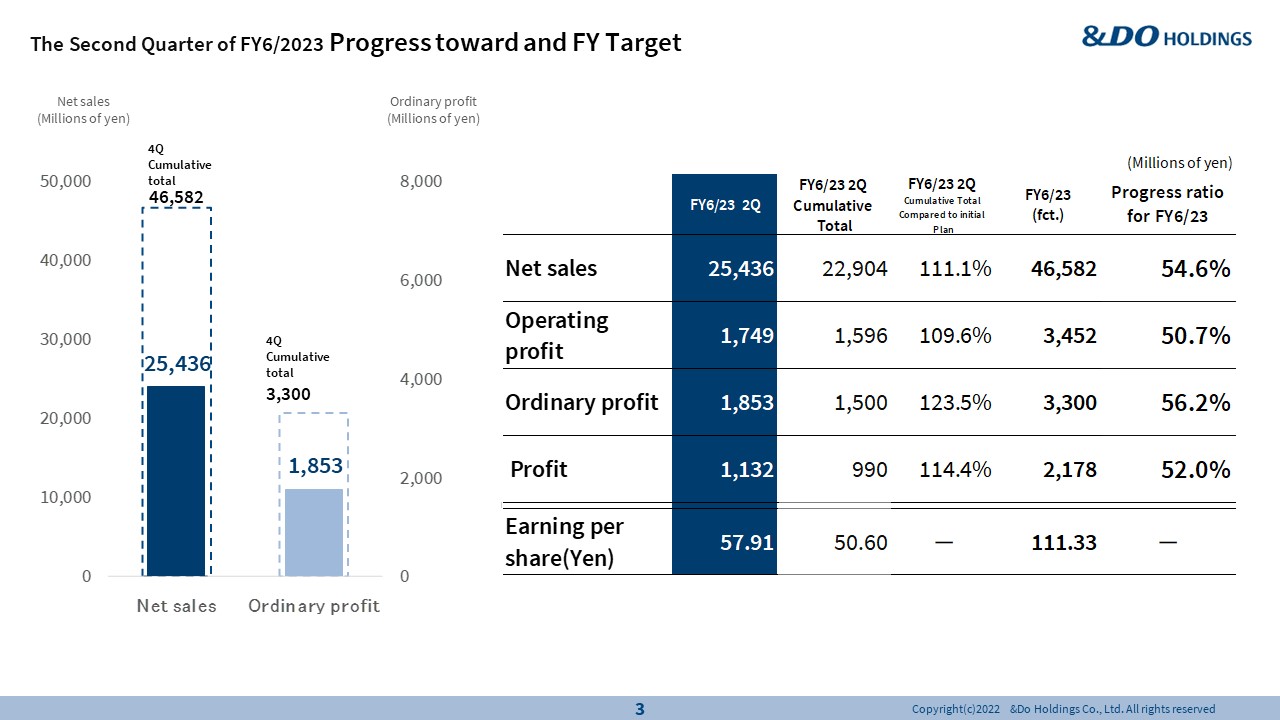

The progress rate for the full year is over half, so the plan of 3.3 billion yen, ordinary profit, for this fiscal year is almost on track. I can't say that it's 100%, but it's coming in a pretty good way, and it's definitely over halfway. -

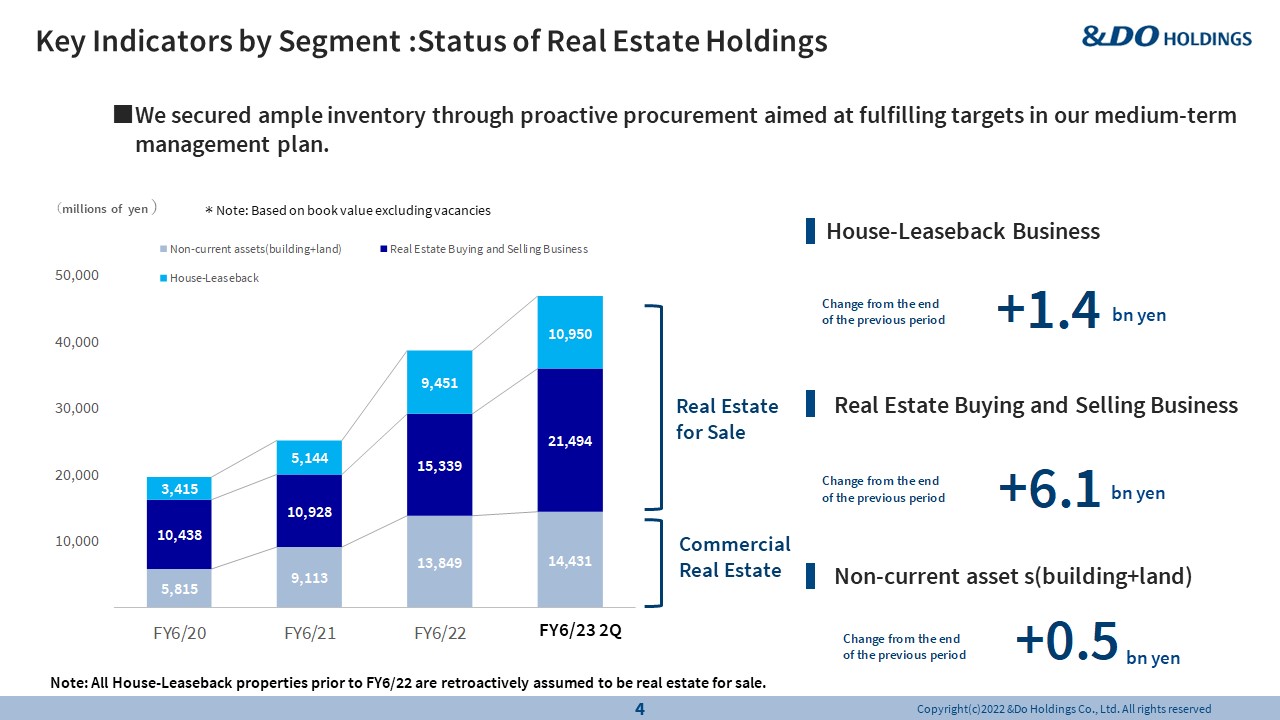

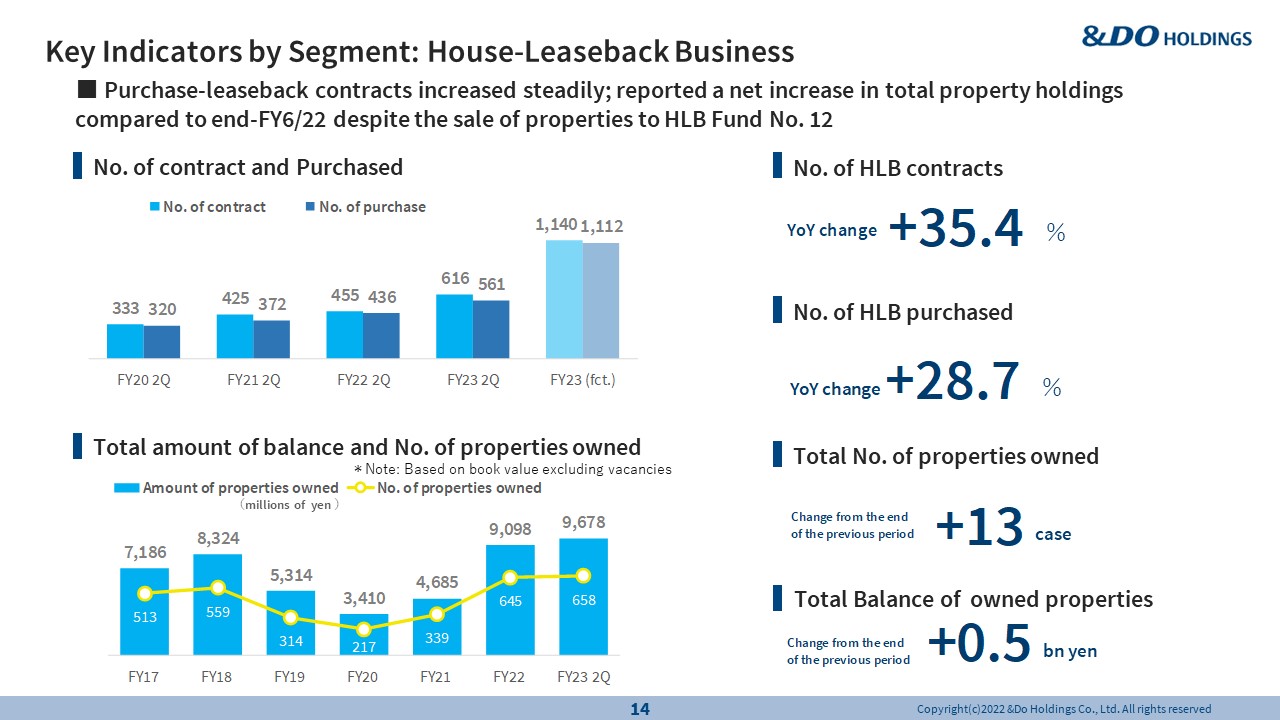

Key Indicators by Segment: House-Leaseback Business

Next, we are steadily purchasing products. This is quite a risk product, but I think the risk is relatively low since we do purchasing in a well-balanced manner. For House-Leaseback, this is also growing smoothly. Then, for the Real Estate Buying and Selling Business is firmly on spot, and we are making purchases. Over the past two years, in the midst of the COVID-19pandemic, we have increased our purchases of cheap buildings, hotel sites, and other such places. However, I would like to go a little more cautiously from here, but we are also purchasing in anticipation of inbound and other related things, so we are accumulating these items. -

The Second Quarter of FY6/23 Summary of Consolidated Statement of Income

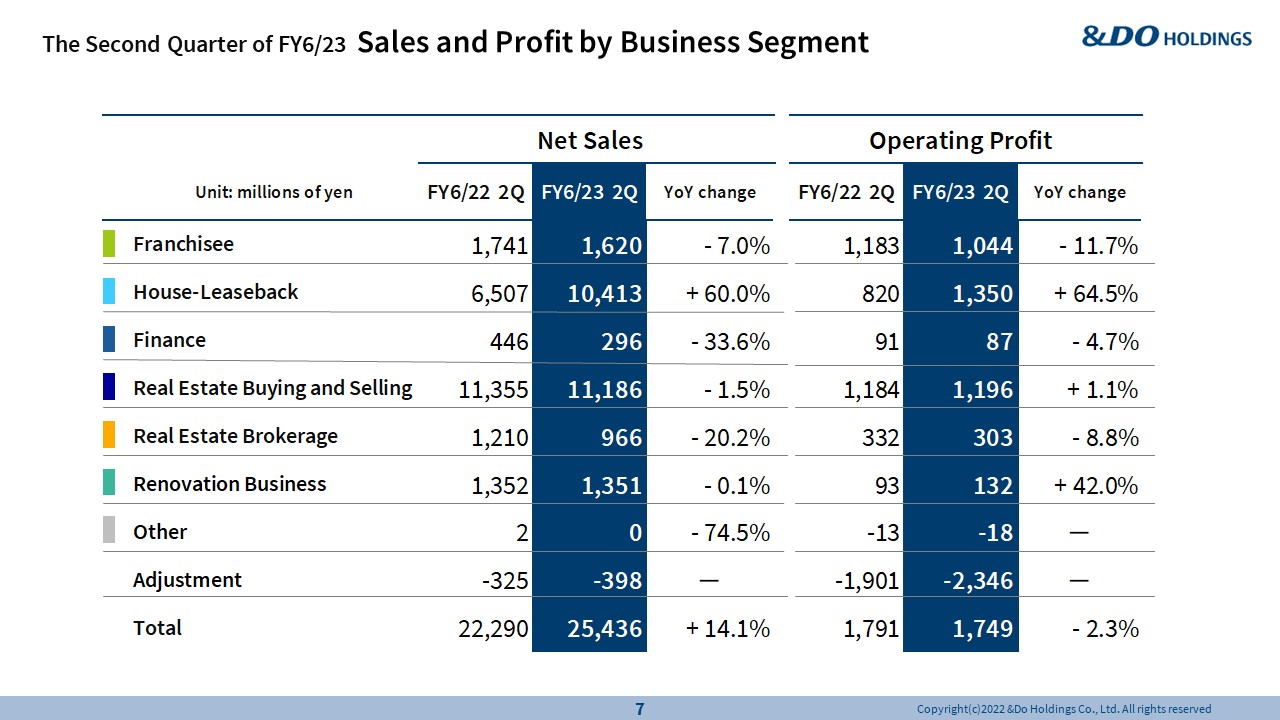

Then, we go by segments. The Franchisee Business is a growth-driving businesses, but it is still decreasing slightly, and the numbers are decreasing. The contents are like this. I don’t think this is bad, but it’s decreasing around here. Then, the House-Leaseback is stretched a lot. We are doing more and more purchasing, so it's going smoothly. And for Finance Business, as I have told you before, we are shrinking the Real estate secured loans Business. Money is being taken to the Real Estate Buying and Selling Business. Since it is better to invest money in the Real Estate Buying and Selling Business, Then, the Real Estate Buying and Selling Business is slightly down by 1.5%. The fact that large-scale properties in the previous term are included means that in terms of content, they are growing. As I mentioned earlier, the Real Estate Brokerage Business means that while the number of stores is reduced, the amount of human resources to be brought to the Real Estate Brokerage Business decreasing. Then, the Renovation Business, which has been standing still for two years due to the COVID-19pandemic, has finally come back to the situation as it was before the crisis, which means that things are finally moving. -

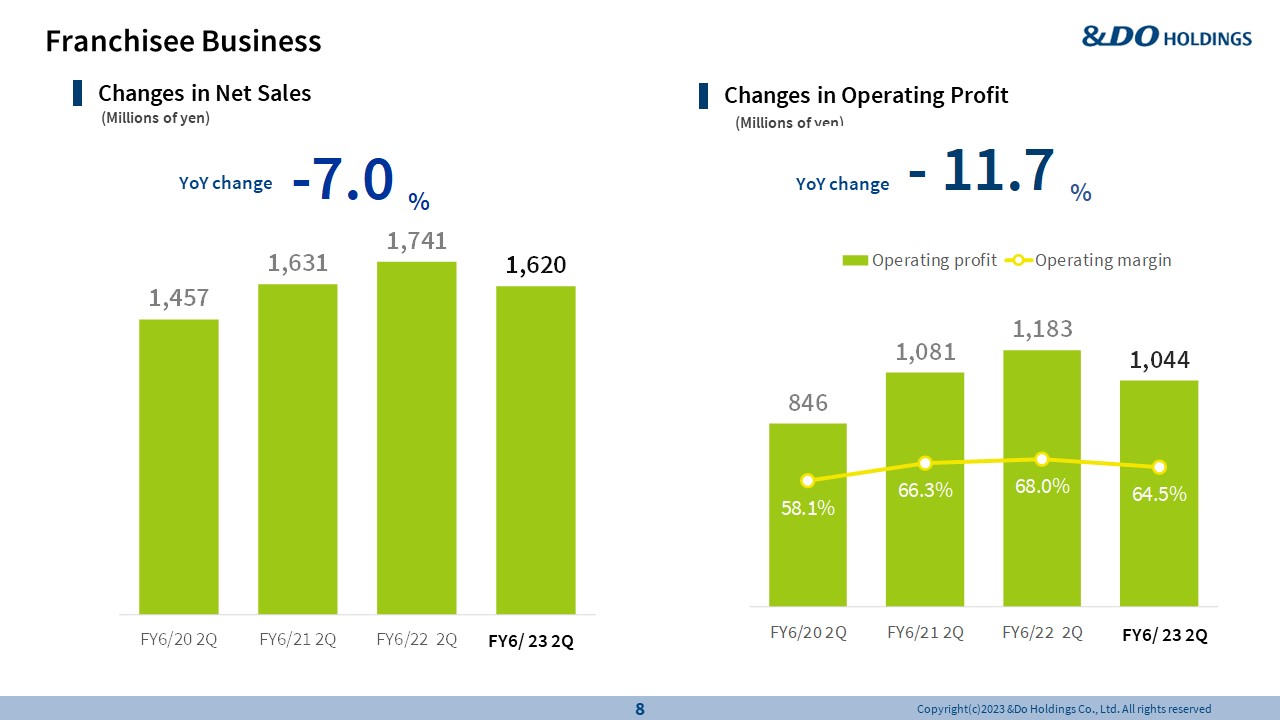

Franchisee Business

Well, although these are my thoughts as an individual, there was a withdrawal of business during the Covid-19 pandemic, and since the main business was useless, it was unavoidable that there were quite a few places where business was withdrawn.. I wonder if one round has been done just yet, but I wonder if it will take about one year from this period. Since the number of new items is increasing steadily, I think that this may be inverted in one round. -

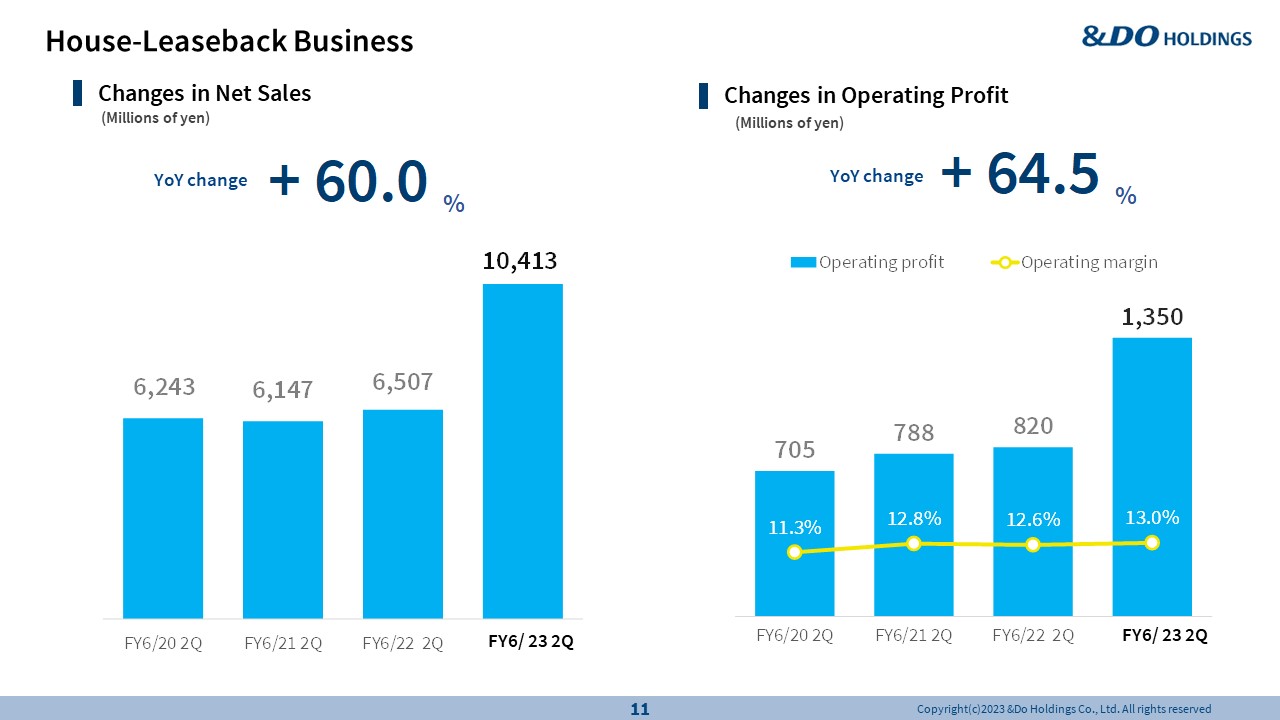

House-Leaseback Business

Next is House-Leaseback Business. We are steadily doing purchasing. However, you need the expenses for this. Earlier, I told you that there was Real Estate Buying and Selling Business from Real Estate Brokerage in the sales business, but here we are also bringing human resources to House-Leaseback Business. -

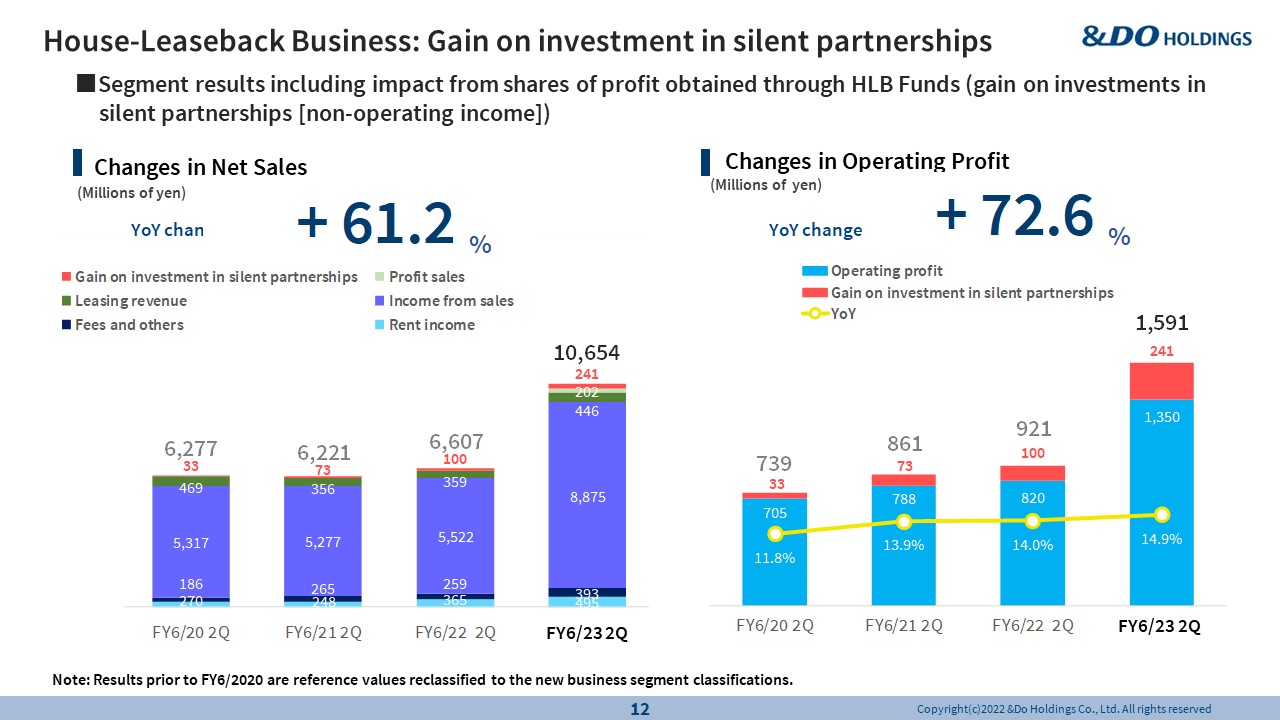

House-Leaseback Business :Gain on investment in silent partnership

Then, this is from the fund, and this deficit, the red part is the dividend. This is also a dividend that comes in regularly. The bigger this fund is I would be grateful if we can continue to see continuous dividends. -

Key Indicators by Segment: House-Leaseback Business

That's why the House-Leaseback numbers are like this. Whether the purchasing, number and amount are going well like this, and whether this grows further or not is being looked at a little this period. Furthermore, we are considering increasing this by 20%, 30%, and 40%. I’m thinking of extending this, but I would like to look at the balance. -

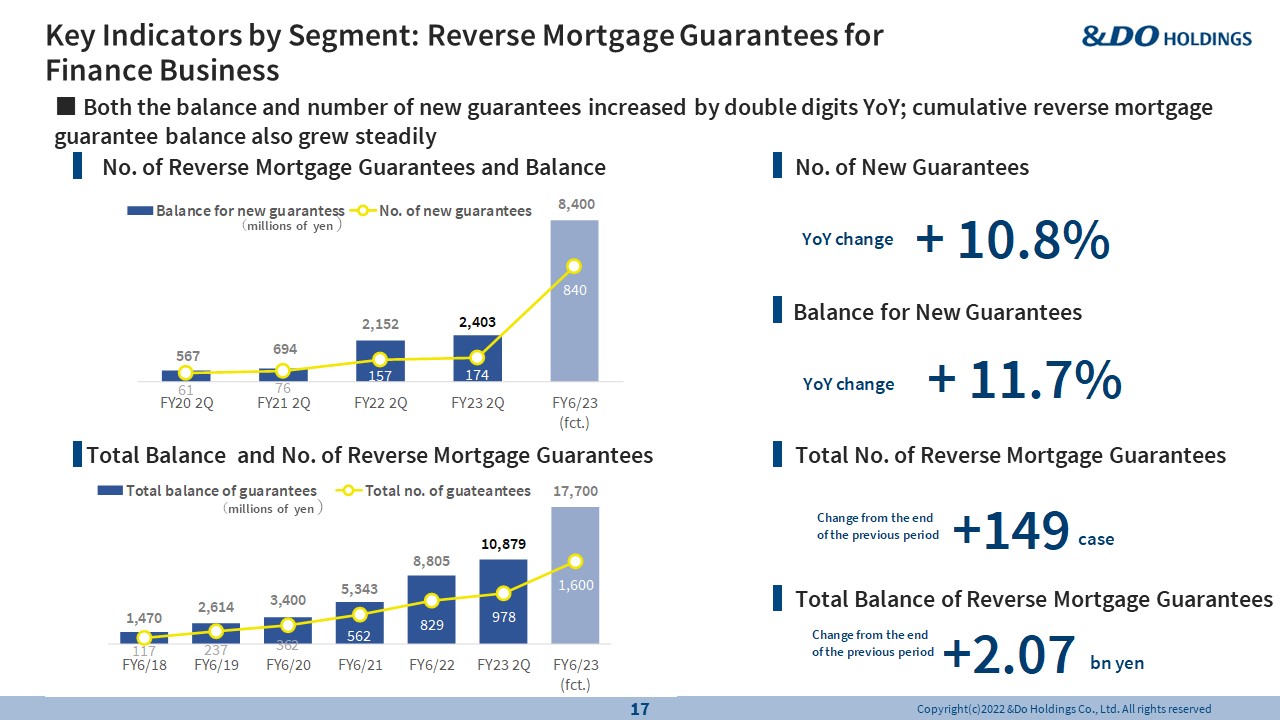

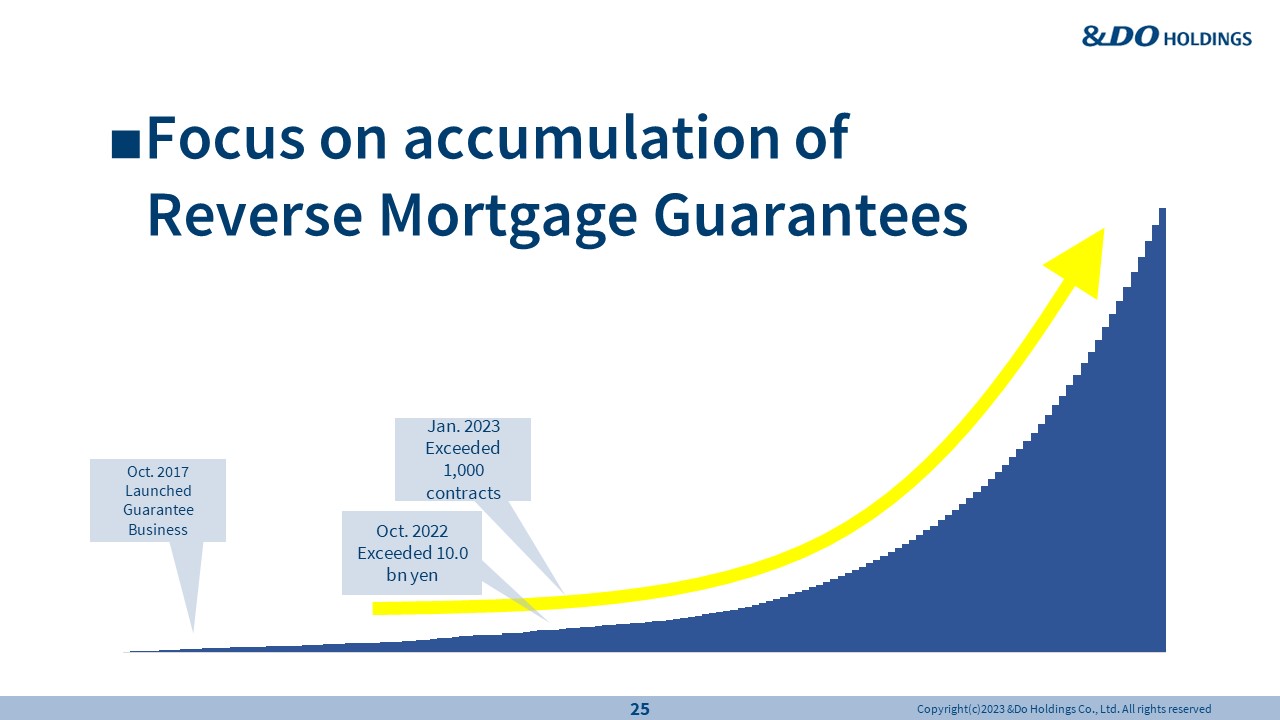

Key Indicators by Segment: Revers Mortgage Guarantees for Finance Business

Then, these are the numbers for Reverse Mortgage Guarantees Business. Although this is slightly later than the plan, we have a very good partnership with financial institutions. Then, recently such articles on reverse mortgages have been attracting a lot of attention. I feel that the era of reverse mortgages is finally coming, but while I feel it might take a little more numerically, I don’t think there will be any change and it's definitely increasing like this. -

Real Estate Buying and Selling Business

Then we have the Real Estate Buying and Selling Business. Even though we're in this situation a little graphically as with large properties in the previous period, if anything, large properties will have a temporary profit for sales. Sales will purchase and sell our specialty, and we will firmly position the Real Estate Buying and Selling Business as an on-site for houses, second-hand houses, and newly built houses. Since the volume of this is solidly increasing now, if this area grows steadily, these will be beautiful numbers. However, we will raise these, and I am thinking that this will continue to grow steadily. -

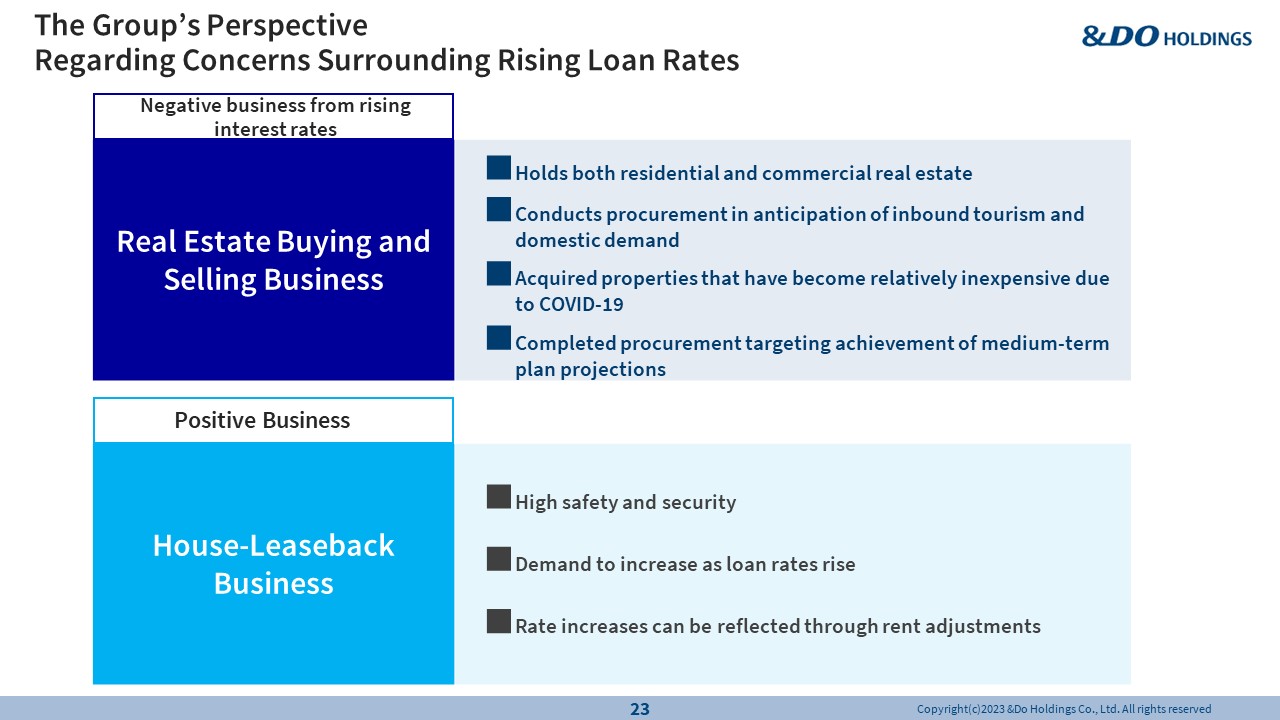

View on Rising Interest Concerns

So, interest rates are a very important point for us in the real estate industry, and in the market, as interest rates raise this way, it seems that they may finally be going up. I would like to conclude by introducing our way of thinking. I wonder what the real estate market will be like in the future, but in the end, domestic travel, inbound travel and tourists visiting Japan from abroad will definitely return, and there are many signs of recovery that are coming out. In anticipation of that, we have been purchasing things in this year such as a hotel site in Kyoto and a small hotel. There may be some increase in interest rates, but I believe that this kind of demand is stronger than the rise in interest rates, and that a slight raise can be pushed aside. As for the housing below, I don't think there is much of an impact on housing loans up to about 1.5%, but to a certain extent, as rates rise, there will be an impact on customers. In that regard, I also experienced the bankruptcy of Lehman Brothers and the 2008 financial crisis, so in general, I think that we will be at a stage where housing loans will affect customers at a level exceeding 2%. While being cautious about that, I think that early action is necessary depending on sales. -

Finance Business(Reverse Mortgage Guarantee Business)

The graphs here show the number and balance of reverse mortgage guarantees. Because the number and balance of guarantees are steadily growing, indicating this business is in line with current trends, although the balance may still be small, we are certain that it will continue growing. Reverse mortgage guarantees are attracting much attention lately. We are seeing an increase in cases where the elderly, in particular, are refinancing their mortgages or using funds from reverse mortgages to purchase homes or condominiums designed for seniors. -

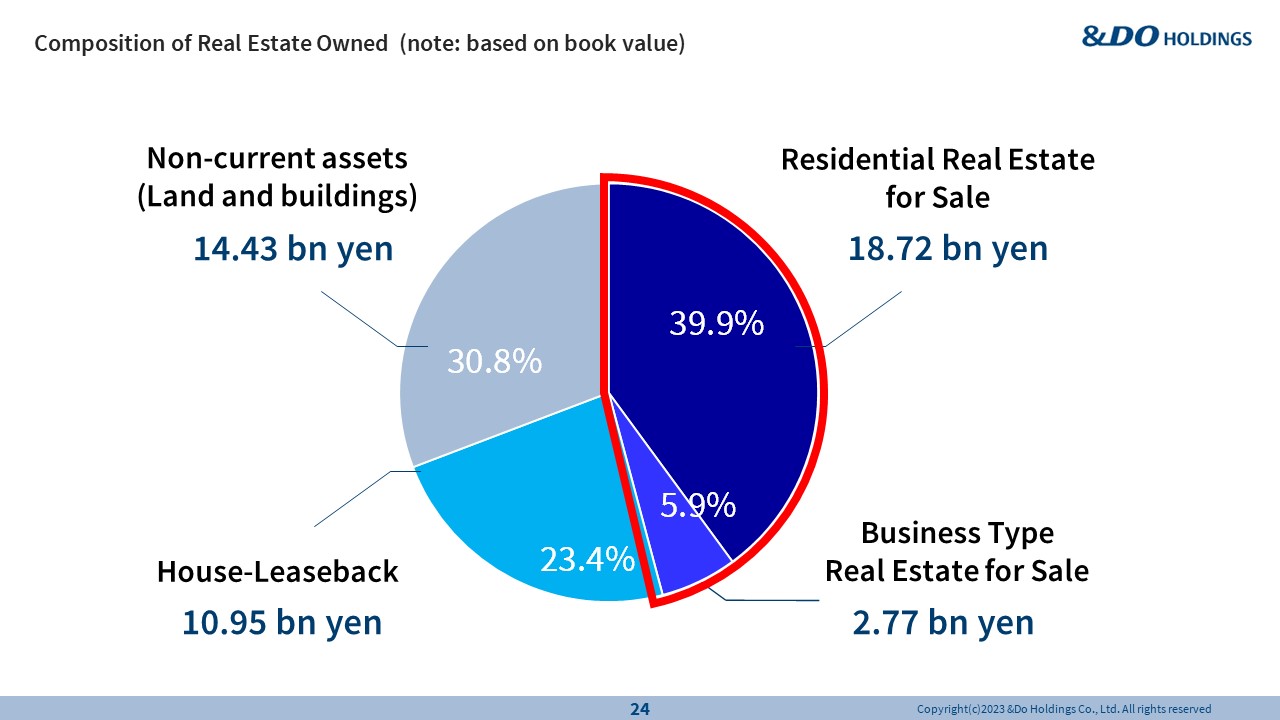

Composition of Real Estate Owned (note :

We are all concerned about future inflation and interest rate hikes. There is a possibility that the Bank of Japan (BOJ) may gradually unwind its monetary easing policies around the end of 2023 or 2024, but I don’t expect the BOJ to raise interest rates rapidly. Assuming that interest rates will rise, I have summarized our views here. If we categorize the areas of the real estate market into A, B, and C, with A being the prime, central area and B an area surrounding A, we wouldn’t have any problem selling properties in these two areas. In terms of proximity to train stations, A corresponds to an area within a 10-minute walk from the nearest station, B roughly 10 to 20, 25-minute walk, and C more than a 30-minute walk, with residential properties scattered throughout. Naturally, when mortgage rates and other interest rates rise and inflation sets in, C is likely to be the most affected. We are making sure not to purchase properties in this area.

Therefore, for newly built homes, A is excellent, meaning we will have no problem selling properties here. B is somewhat favorable, with some minor concerns, and properties will sell if they are of good quality. However, B also faces strong competition from other new home builders, and sales will inevitably suffer if supply is in excess. C will have much difficulties if prices rise. For pre-owned houses, both A and B are excellent, in that pre-owned houses are unique and face less competition. For newly built homes, there are usually 10 to 20 units being offered for sale per development project, which works to increase competition, and if they don’t sell, it would be difficult to sell similar properties. It’s all about finding the right balance between supply and demand. With pre-owned houses, we can renovate them and sell them. These properties will naturally be priced lower than newly built homes, and as long as they are of good quality and offered at a reasonable price, they can attract buyers who are often residents in the neighborhood. We will conduct thorough marketing to purchase pre-owned houses and renovate them to ensure sales. This is also true for regional areas. Regional areas can also be categorized into A, B, and C, and we are not against venturing into these areas.

-

Our Group’s Views on Rising Interest Rate Concerns

Finally, I believe the House-Leaseback Business is particularly resilient and will perform even better during periods of rising interest rates and inflation. In challenging times like these, strict loan screening processes and rising interest rates will present challenges for certain customers seeking loans and will put financial pressure on companies with outstanding loans. These customers and companies, I believe, will be attracted to our house-leaseback offerings. I can assure you from my experience.

I don’t think it’s too late to step up efforts aimed at growth from now on, so we will work to find a good balance in growing our business.

Thank you for your attention.

-

Opportunity to expand procurement of House-Leaseback properties

This is, I've said this many times before, if interest rates rise, House-Leaseback Business are after all a chance to re-expand purchasing. Since I think it will be like this, even if there is no rise, I'm thinking of expanding the purchase of House-Leaseback while watching the situation, but in such a situation, I think it would be even more of an opportunity. For that reason, we are fully aware that we have to make sure that our financial content is stable and sound, so while we took a lot of risks in the last two years, I believe that we must make a solid profit and maintain a sound financial structure. -

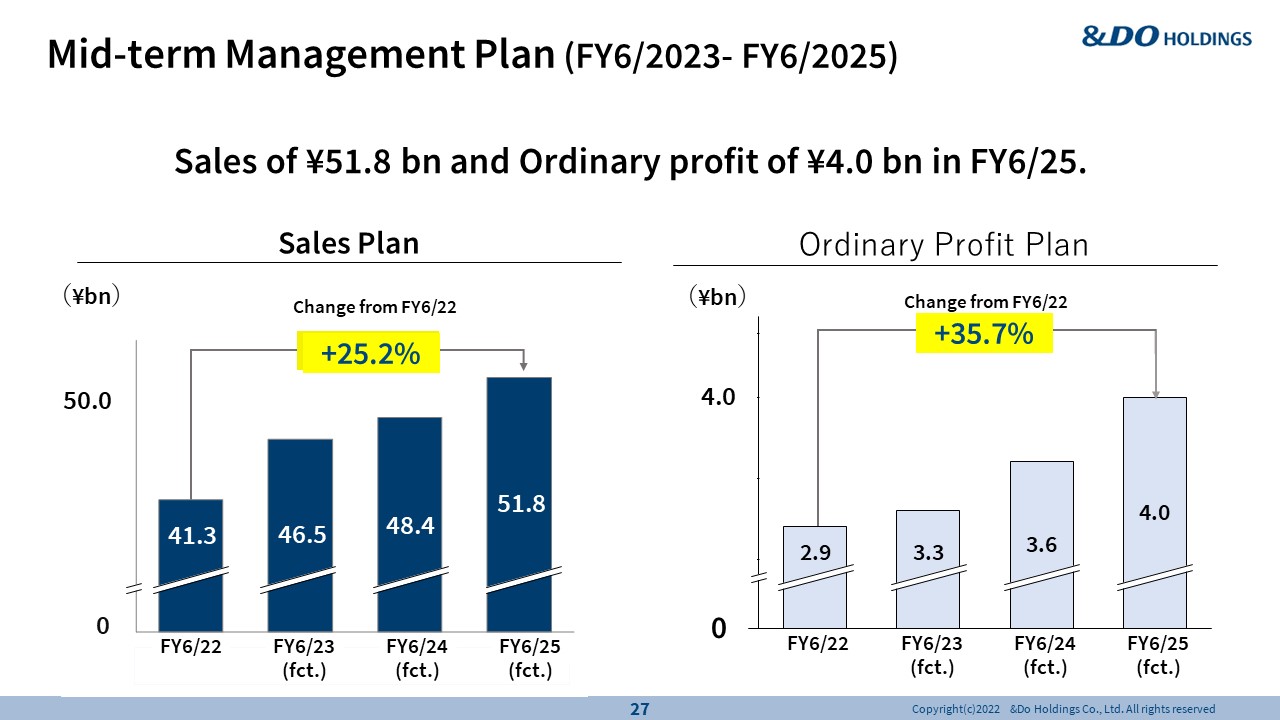

Mid-term Management Plan (FY6/2023-FY6/2025)

Well, for this three-year plan, Medium-Term Management Plan, which is the part that we have announced, we would like to firmly aim for 4 billion yen, ordinary profit, in three years. Roughly from now, if things go smoothly, we will achieve an ordinary profit of 4billion yen. We have already made enough allowances, so we want to do this firmly and reliably. -

Medium-Term Management Plan : Three Growth Strategies

Finally, I will announce these three items. While steadily expanding our growth strategies and growth-driving businesses, while doing the Real Estate Buying and Selling Business a little cautiously, in terms of fusion for real estate and finance, we would like to do our own management. Then, we are thinking about building a solid high-profit structure and becoming an excellent company. Thank you very much for listening.